The Future of the Longevity Financial Industry

Healthy Longevity will reshape the global financial system and disrupt the business models of pension funds, insurance companies, banks, investment firms, and entire national economies.

The Longevity industry will dwarf all other industries in both size and market capitalization. At the same time, it will require unprecedented sophistication in its approach for assessment and forecasting from the start in order to neutralize challenges and reveal opportunities. The Longevity industry consists of multiple sectors - Science of Aging, Preventive Precision Medicine, AgeTech, and Novel Financial Systems. The reason why the Finance industry is so pivotal to the Longevity industry compared to other sectors, is that global finance itself has reached a crossroads where it must decide how to approach the issue of a global aging population - as either a threat, or as The Next Big Thing and a Multi-Trillion Dollar opportunity.

-

The recognition of these issues has resulted in an increased number of Longevity-themed top-tier conferences taking place globally, events and analytical research by biggest investment banks, the audience composition of which demonstrates a widespread recognition among the financial sector of the challenges it faces, but also a degree of awareness of prospective opportunities.

-

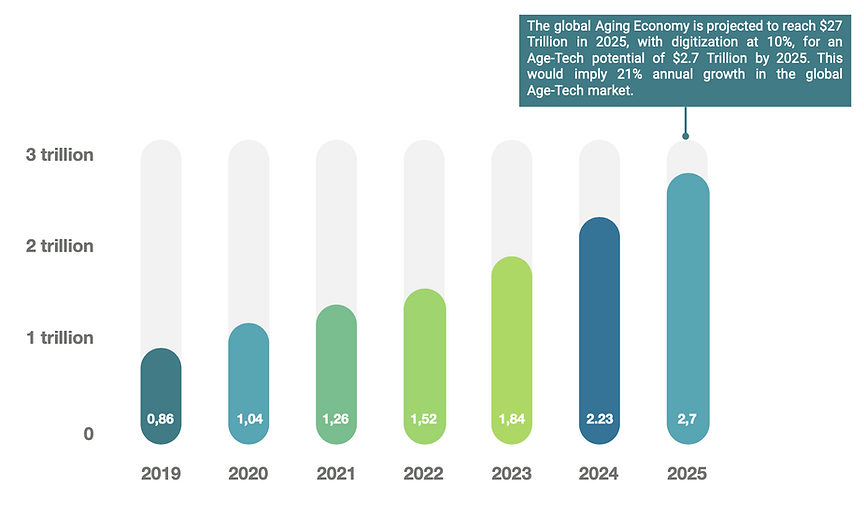

AgeTech and WealthTech for seniors, two rapidly developing sectors, provide new types of products and demonstrate the significant growth in the size of the market. WealthTech is providing innovative products, such as Robo-financial advisors and digital brokers supervised and augmented by AI. AgeTech is designed to support the elderly and reduce the consequences of aging in everyday life. Over the next few years, it is likely that both will come to be regarded as complementary functions within a single product or service. One example of this combination will be a new type of FinTech banks reconfigured for seniors as an AgeTech-Longevity bank.

-

Novel financial systems which are relevant and adjusted to increasing healthy life expectancy including the AgeTech-Longevity bank, the Longevity investment index and hedge fund, and a specialized Longevity stock exchange will together provide multiple types of Longevity-associated derivatives. This will spawn a whole new industry, the capitalization of which could exceed anything ever conceived of by financial markets.

-

A fully-fledged Longevity financial industry will be heralded with the creation of a Longevity stock exchange that deals with specialized derivatives. And eventually, by the Longevity Composite Index, similar to the Nasdaq Composite. This will be the means by which investors will provide unlimited liquidity to the Longevity industry (the same way it currently does with the real estate industry).

-

This leads to a self-sustaining cycle of growth in the Financial Longevity industry whereby the effect of aging on GDP is repeatedly offset and the resultant wealth is repeatedly reinvested into technologically reinvigorated human capital.

-

Aging Analytics Agency produced a Landmark analytical report Advancing Financial Industry focused on the intersection of Longevity, AgeTech and the Financial Industry.

-

Many of the financial reforms described in this article can realistically only be implemented in progressive countries lead by technocracy-driven governments, such as Switzerland, Singapore, and the United Kingdom with its detailed industrial strategy.

-

In this article we have summarized our forecasting on the Future of the Longevity Financial Industry, and how Healthy Longevity will reshape the global financial system and disrupt the business models of pension funds, insurance companies, banks, investment firms, and entire national economies.

.png)

Aging Analytics Agency’s MindMap of the top 150 financial institutions participating in Longevity industry. Source: Advancing Financial Industry Longevity / AgeTech / WealthTech Volume I

There are also questions about Longevity which we will answer at the end of this article. These are the common questions about Longevity itself and the industry as a whole that financial experts may have:

-

Does progress in Longevity imply that the rich will be living long and healthy and lives, with unique access to super-expensive life extension technologies, eventually making themselves super humans, while the poor will be living a short lives in poor health?

-

Would not increased life expectancy lead to overpopulation and exacerbate the pollution problem?

-

In a world of Longevity Finance, which will be a more precious asset for investment: physical wealth (such as real estate), or health (if indeed it becomes a new asset class)?

-

What is Longevity escape velocity and why does it matter so much for the financial Longevity industry?

-

What is the most efficient and ethical way of conducting business and generating high profits and at the same time delivering effective altruism in practice?

CONTENTS

THE INCREASING ROLE OF LONGEVITY IN GLOBAL FINANCE

In our previous article, we asserted that the Longevity industry will be the biggest and most complex industry in human history, and that the increasing interconnectivity and synergy between these domains will eventually make Longevity an asset - literally a new asset class. The increasing role of the financial system is of particular interest to Aging Analytics Agency as financial institutions such as investment banks, pension funds, and insurance companies, have reached an inflection point whereby they can either sink or swim when faced with the oncoming “Silver Tsunami” - the global aging population.

LONGEVITY, AGETECH AND WEALTHTECH

There are megatrends which are currently driving the growth of the rising Longevity, AgeTech (technologies and services that are directed at supporting the elderly) and WealthTech industries. Due to the increase in life expectancy and the spread of Silver Tsunami, we can observe the development of such sectors of the Longevity industry as AgeTech and WealthTech designed for people expecting to live 100 years. These sectors are expanding in a synergetic manner. Longevity enables AgeTech, AgeTech enables centenarians’ WealthTech, WealthTech supports further growth interest to Longevity as an industry. This makes their ongoing emergence and growth almost inevitable.

LONGEVITY STOCK EXCHANGE

The launch of a specialized Longevity stock exchange and Composite Longevity Index is the culmination of the Longevity industry’s transformation into a fully fledged and matured industry. This would provide increased liquidity, which in turn would enable greater flexibility and greater leverage for the further growth of the companies listed on the exchange, and as such greater opportunities for the advancement of the Longevity industry as a whole globally.

ADVANCING FINANCIAL INDUSTRY - LANDMARK ANALYTICAL REPORT

Aging Analytics Agency produced a landmark analytical report Advancing Financial Industry focused on the intersection of Longevity, AgeTech, WealTech and the Financial Industry, a domain that is dominated by a high degree of complexity. The report delivers practical answers to specific questions concerning the influence of ageing on financial institutions’ activity in order to optimize their short and long-term strategies, with a new updated edition being released each financial quarter, incrementally increasing the precision, relevance and actionability of its industry analysis.

LONGEVITY-PROGRESSIVE COUNTRIES & GOVERNMENT NATIONAL LONGEVITY DEVELOPMENT PLAN REPORT

Many of the financial reforms described in this article can realistically only be implemented in progressive countries led by technocracy-driven governments, such as Switzerland, Singapore and the United Kingdom with its detailed industrial strategy. This was one of our reasons for publishing our Government Longevity National Development Plans Global Overview 2019, and with this Longevity-progressive governance in mind several global hot spots of Longevity finance were identified and justified in the Advancing Financial Longevity Industry report. This political, policy and governance dimension will be discussed in the article we will publish next week.

THE INCREASING ROLE OF LONGEVITY IN GLOBAL FINANCE

In our previous article we asserted that the Longevity industry will be the biggest and most complex industry in human history, that it is already much more than just geroscience, and that it consists of multiple sectors - Science of Aging, Preventive Precision Medicine, AgeTech, and Novel Financial Longevity Industry. We stated that the increasing interconnection and synergy between these domains will eventually make Longevity into an asset - literally a new asset class. The increasing role of the financial system is of particular interest to Aging Analytics Agency as financial institutions such as investment banks, pension funds, and insurance companies, have reached an inflection point whereby they can either sink or swim when faced with the oncoming Silver Tsunami - the global aging population.

We provided a brief overview of the scope and dynamics of the industry, and discussed the current challenges, opportunities and approaches to tangible, pragmatic, realistic assessment and forecasting, for each new side of this rapidly growing and diversifying multifaceted industry.

.png)

In this article we explore one important new facet: the increasing role of Silver Tsunami and healthy Longevity in the global finance, and how financial institutions such as investment banks, pension funds, and insurance companies, can either stagnate hit by the oncoming “Silver Tsunami” or will thrive if they will implement novel business models relevant to the new era of increased healthy Longevity.

The increasing relevance of Longevity to finance has already been well recognized among the international financial community. Each year an increasing number of forums and conferences are held on the topic; even well-renowned and respected brands such as The Economist and Financial Times are now regularly hosting conferences and panel discussions on the subject of aging and the business of Longevity. And the biggest investment and private wealth banks are issuing analytical reports for their clients on this topic, and beginning to structure new financial products.

However, a mere three years ago optimism regarding the real emergence of geroscience and Longevity was yet very low, and it was nearly unthinkable that this topic could be included at all in the agenda of major conferences and big banks. But the outlook has now changed, and healthspan extension is now a logical topic of discussion for world-leading healthcare thought-leaders. The science of aging has matured, the advanced biomedicine is actively implementing modern preventive precision medicine techniques and we are now witnessing the dawn and rise of the Longevity industry, including its financial sector, which eventually will become unprecedented by its capitalization.

.png)

Source: Advancing Financial Industry Longevity/AgeTech/WealthTech Volume I

The current financial system adopted its present form over 50 years ago at a time when nobody could have imagined that life expectancy could increase by much at all, let alone to the extent by which it has increased in the past 40 years. To adjust to this new reality, global financial institutions and entire nations will have to endure multiple paradigm shifts quickly to avoid stagnation within the next 10-15 years. Some countries such as Japan are already suffering from the Silver Tsunami.

One of the factors already making a significant impact on the global financial system is the gap between the rising life expectancy and HALE (Health-Adjusted Life Expectancy), QALY (Quality-Adjusted Life Years) and DALY (Disability Adjusted Life Years). Due to advances made in healthcare systems and BioPharma, people are now living longer, but not healthier, and without a corresponding increase in HALE and QALY. People are being rescued from death, and to some extent from disease, but not from general infirmity, and so their period of being economically unproductive is increasing.

.png)

Comparison of Health-Adjusted Life Expectancy with Life Expectancy of developed countries in 2016. Sources: Government Longevity National Development Plans Global Overview 2019, GHO Life expectancy and HALE

As can be seen from the findings of Aging Analytics Agency's "National Longevity Development Plans" report, the gap between life expectancy and Health-Adjusted Life Expectancy (HALE) varies widely among developed countries, and can be seen as a direct result of the relevance and proactivity of their efforts to embrace the paradigm shift from treatment to prevention and from Preventative Medicine to Precision Health.

This widening gap could be considered as the rising tide of the Silver Tsunami. One of the most illustrative case-studies of this gap is Japan, which experienced an economic boom 50 years ago that nearly allowed them to exceed the USA in terms of GDP; concomitantly, Japan’s life expectancy also nearly outgrew life expectancy in the US, although without an equal increase in its citizens’ healthspan.

This gap created a significant negative impact on Japan’s national economy, which has been stagnating for the past 20 years as a result. Japan’s government has spent massive effort on financial engineering to account for this gap, but have only succeeded in delaying the collapse of their economy, not fixing the fundamental cause behind it. Japan and its major financial institutions should be motivated more than any other nation today in adopting a combination of advancements in biomedicine and advancements in the financial sphere to synergistically avoid stagnation and collapse in the face of this big gap.

However, there are alternative positive scenarios available which are more likely to be explored by the more progressive, technocracy-driven nations and financial institutions. There are two main scenarios, described in the graph below, of how the collision of two megatrends - Advancing Biomedicine and Silver Tsunami is going to develop.

.png)

Two scenarios of the Longevity MegaTrends development for nations. Source:Advancing Financial Industry Longevity / AgeTech / WealthTech Volume I

A range of novel financial institutions that could ride this rising tide are expected to appear and develop; such as Longevity-focused venture funds, Longevity-AgeTech banks, Longevity index funds and hedge funds, and even a specialized stock exchange for Longevity-focused companies and financial products.

.png)

Longevity financial institutions of the future, presented in chronological order of their likely emergence Source: Aging Analytics Agency’s 2017-2018 Global Longevity Landscape Overview analytical report assessment

Furthermore, the above-mentioned trends have a major influence on the development of AgeTech and WealthTech industries, analyzed in the next chapter.

AGETECH AND WEALTHTECH

Due to the increase in life expectancy and the spread of Silver Tsunami, we can observe the development of such sectors of Longevity industry as AgeTech and WealthTech designed for people expecting to live 100 years. These three industries are expanding in a synergetic manner. Longevity enables AgeTech, AgeTech enables centenarians WealthTech, WealthTech supports Longevity. This makes their ongoing emergence and growth almost inevitable.

.png)

The sources of AgeTech and WealthTech development. Source: Advancing Financial Industry Longevity / AgeTech / WealthTech Volume II

One of the most notable representative examples on this matter is Centenarian club created by UBS. In April 2018, UBS Investor Watch, the world’s largest surveyor of wealthy investors, polled 5,000 high-net worth individuals (HNWIs), defined as having at least $1m in investable assets and documented the general state of individual investor optimism regarding longevity globally. The report concludes: “The idea of living a century was once confined to science fiction. But no longer. For the world’s wealthy, living a 100-year life is not an outcome they consider a mere possibility. It’s one they expect.” Thus, the report proves the optimistic expectations of investors concerning the lifespan expansion.

.png)

UBS Centenarians Club. Source: Aging Analytics Agency’s 2017-2018 Global Longevity Landscape Overview analytical report, UBS Investor Watch

AgeTech refers to the technologies and services that are directed at supporting the elderly and reducing the everyday consequences of ageing. These most typically consist of IT-related products and services, such as smartphones, tablets and computers optimized for ease-of-use for those aged 60 and over, or novel banking interfaces and services that enable the elderly to conduct their daily banking with less difficulty, and which protect them from financial fraud. AgeTech products for seniors include: Medical Alert system, Phone Amplifiers, Senior Care Robots, Walking Aids, Medication Dispensers, Smart Beds, Electric Kitchen Tools.

However, the list is not limited only to these segments. For instance, one recent trend is a growth in demand for smart homes for elderly. This is connected to the fact that some fraction of the elderly prefers staying at home for most of the time and require special care, which can be provided using AI products and services.

Meanwhile, the WealthTech industry comprises any product or service (again, almost invariably IT-based) that either simplifies or enhances the creation and maintenance of Wealth - from savings to investment - for all ages of society.

The term covers the new generation of financial technology companies that create digital solutions to transform the investment and asset management industry. New companies are arriving on the scene offering advice based on artificial intelligence and big data. These include:

-

Robo-advisors - automated services that use machine-learning algorithms to provide users with advice based on the most profitable investment options, yield targets, user’s risk aversion profile and other variables.

-

Robo-retirement - another version of robo-advisors that is especially popular in the United States. Companies in this category specialize in managing retirement savings.

-

Digital brokers - online platforms and software tools that put stock market information and the possibility of investing within anyone’s reach.

-

Financial products designed for investors expecting to live 100 years and beyond.

The WealthTech industry is currently anticipating the emergence of new wealth management technologies. With the use of such technologies, and by adapting existing products and services, financial service innovators have an opportunity to greatly enhance the financial lives of the over-50s. The depth and diversity of this group create an incredible opportunity to implement innovations on their behalf and address their financial health challenges head on.

As AgeTech and WealthTech converge, the financial industry is likely to see the emergence of what can be referred to as AgeTech-Longevity banks, a novel type of institution focused on simplifying banking for people over 60. It would, in most respects, resemble a traditional fintech bank returned for elderly clients. One of the few remaining steps left on the road to an AgeTech Bank is the development of smartphones tailored for the elderly, an innovation which could be achieved within a year.

.png)

The sectors and subsectors of Longevity Financial Industry. Source: Advancing Financial Industry Longevity / AgeTech / WealthTech Volume I

What to expect from AgeTech and WealthTech in the next few years

-

Rising life expectancy will create major opportunities for the financial sector, because the elderly as a special social group has common characteristics and common needs to satisfy. We should therefore expect an increase in the products targeting seniors, such as AgeTech.

-

All in all we can expect to see the WealthTech industry become more old-age-oriented, offering an increasing number of products and services to those aged over 60 as the proportion of citizens in retirement continues to grow.

-

Over the next few years, it is likely that AgeTech and WealthTech come to be regarded as complementary functions within a single product or service. While WealthTech industry is providing innovative products, such as Robo financial advisors, digital brokers and micro-investments. Top countries embracing WealthTech include the US, UK, Japan and France. On the other hand, AgeTech is directed to support the elderly and reduce the consequences of aging in everyday life.

-

The AgeTech segment’s potential is forecasted to reach $2.7 Trillion by 2025, showing 21% annual market growth.

-

This explosive growth will be accompanied by a proliferation of products that concentrate on satisfying the demand for different individual types of savings, specialized retirement plans and for the financial advising for the elderly. As a consequence, newer types of financial products - newer asset classes, newer investment strategies and longer-dated bonds/securities - will need to be developed.

AGETECH-LONGEVITY BANK

Technological progress brings both challenges and opportunities. In 2014 UK non-cash payments exceeded cash payments by volume for the first time. New technology holds out the promise of better, cheaper services – but only if a sufficient range of well-designed options are available for a consumer marketplace with a very diverse range of needs. The fast pace of change is difficult for many people to adjust to. Bank branch closures, for example can be particularly challenging for socially or digitally excluded older people. New technologies bring convenience, but also new opportunities for fraud and scams.

Today we can see a significant raise of Fintech banks, redefining the banking industry by connecting with a new generation of mobile-first consumers. The brightest examples of digital banks in the UK are Revolut, Monzo, Starling Bank; in Europe - Curve and N26: in USA - BankMobile and GoBank. Fintech banks are chasing income from the middle-age and younger generation, while missing 1 Billion Consumer or 15 Trillion Dollar Market opportunity, developing technology only for a limited age category.

As the share of the population above 65 is increasing in every member state of the European Union, European banks are lagging behind in finding solutions for this age group, especially taking into account the fact that seniors are holding the lion’s share of the savings. Traditional banks , as opposed to challenger banks, are making their first steps in AgeTech, adapting their infrastructure for the Elderly, for example, HSBC has partnered with the Alzheimer’s Society to create dementia-friendly products, while Barclays is actively developing software for seniors to make their customer experience more comfortable.

.png)

AgeTech - Digitally Enabling the Longevity Economy. Source: Advancing Financial Industry Longevity / AgeTech / WealthTech Volume I

Fintech focused on financial wellness is just beginning to emerge. Aging baby boomers approaching retirement are interested in using tech and AI for financial planning. In a few years financial startups targeting the mass market or focusing on the Millennial generation will face consumer problem and convulsively begin to focus on the older market, while firms that target the senior segment of the population will have taken 70% of the market by this time.

Financial companies, currently working with 55+ aged segment, are mainly focused on applying AgeTech for protecting older people’s finances while ensuring that they do not surrender their independence. An interesting point for the financial sector to note is that, according to doctors, the first easy sign to detect severe declines in cognitive abilities are the bad financial decisions that patients start to take. For instance, paying the same bill twice, being an easy victim of scams, withdrawing money for people that are taking advantage of them, etc. EverSafe is one of the companies, who prevent financial exploitation of seniors, offering a detection and alert system designed to get in front of identity theft and other financial crimes.

In the nearest future we are expecting the groundbreaking synergy between innovative IT-technologies, wealth management, artificial intelligence and traditional banking services, designed and adapted for retirees and seniors, which will lead to creation of AgeTech-Longevity banking trend. Using progressive AgeTech technologies will make access to banking services easier, bring new simply designed products at transparent costs, and the fulfillment of typical and atypical needs will make banks old age-friendly, and establish trust and the much needed financial security among senior customers.

For a number of years, Deep Knowledge Ventures was specifically interested in this topic of bridging AgeTech and FinTech, and gathered significant expertise in this field. In Q4 2019 we will launch a new substantial grand project, which will be focused on this field, leveraging AgeTech banking to the brand new level, targeting the market of 80-100 year old citizens, in some particular cases even up to 100-120 year olds, and putting care for seniors at the heart of our technological, financial and business proposition.

These new elements and segments of the novel financial system will together provide multiple types of Longevity-associated derivatives. This will spawn a whole new industry, the capitalization of which could exceed anything ever considered by financial markets. It will also produce a large quantity and diversity of derivatives, which in turn will support a second and third layers of derivatives, which in turn will give rise to the biggest possible market for derivatives imaginable.

LONGEVITY FINANCIAL DERIVATIVES AND STOCK EXCHANGE

Specialized stock exchanges are nothing new. Currently for example, investors can dig into about 50 major commodity markets worldwide. Those include markets for soft commodities such as wheat, coffee, cocoa and other agricultural products, and markets for commodities that are mined, such as gold and oil. NASDAQ fits that profile as well; it was created as a stock exchange for IT-companies and is currently the home of tech-oriented stocks.

The most relevant example is the recently launched Silicon Valley Stock Exchange backed by Marc Andreessen, and other tech heavyweights, that will give high-growth technology companies more options to list their shares outside of the traditional New York exchanges.

Specialized stock exchanges typically form when an industry grows by a sufficient amount, and with the Longevity industry in its present state of maturation, a Longevity stock exchange now appears to be inevitable. Setting up a Longevity Stock Exchange would require the public listing of at least 100 Longevity-focused companies to create good enough diversity and potential volume for trading.

This would provide increased liquidity, which in turn would enable greater flexibility and greater leverage for the further growth of the companies listed on the exchange, and as such greater opportunities for advancement of the Longevity industry as a whole globally. Thereafter, the more advances there are in Longevity, the more even the most conservative investors will want to invest. By that point they will have been well advised that Longevity is an industry like no other.

It is by such means that increased global Longevity will be transformed from a threat into an opportunity.

.png)

Self-perpetuating cycle of Longevity Finance. Sources: Advancing Financial Industry Longevity / AgeTech / WealthTech Volume I, Global Ageing Report, World Economic Forum, Finances in Retirement

As the share of the elderly in the economy grows, this leads to a self-sustaining cycle of growth in the financial industry whereby the effect of aging on GDP is repeatedly offset and the resultant wealth is repeatedly reinvested into technologically reinvigorated human capital. The greater the progress in achieving healthy Longevity, the more the owners of wealth will want to invest in the labour force, which being endowed with greater healthspans, will bring further growth and even greater healthspans, and so on.

.png)

Self-inducing cycle of Longevity Finance. Source: Aging Analytics Agency’s analytics

Why is Liquidity the Thing that is Needed to Set this Cycle in Motion?

During the past several years, a quite clear disproportion has emerged between DeepTech sectors, in particular between the Longevity startups on the one hand, and the entire business model of venture capital funds on the other. There have also been big gaps and disruptions in the global financial system. There is a highly relevant big gap between progress in science and technology, and the outdated bureaucracy in which most financial institutions remain mired, as though both exist in parallel universes.

This is happening for multiple reasons:

At one end, DeepTech startups (including Longevity start-ups) have been suffering from a lack of access to relevant levels of seed investment. Although venture funds by definition are supposed to prioritize investments into the most disruptive technologies and startups, in reality, most of them prefer to specifically avoid DeepTech sectors, or to enter investment rounds at much later stages. As a consequence, the startups are forced to deal with angel investors. This creates a growth gap phenomenon known as “Death Valley”: 99% of DeepTech startups do not survive the stage of the growth between seed financing and the beginning of revenue generation or even “A” rounds.

Meanwhile, at the other end, there is an extreme abundance of significant assets being held and preserved in bank accounts or in comparatively stable derivatives on a scale of tens of trillions. For instance, there is a tremendous volume of money on the scale of at least 1 trillion euros currently being stored in Swiss bank accounts with negative interest rates, which is illogical phenomenon of a modern financial world itself. Yet the owners of these financial assets would nonetheless prefer to avoid investing them into venture funds, who are equally reluctant to invest into Longevity startups.

Thus, the major source of these disproportions comes down to the issue of illiquidity.

There are many thousands of HealthTech startups and hundreds of Longevity startups in the UK, EU, USA and Asia-Pacific region and 99% of them are not publicly traded, which means that they are limited to seeking funding from angel investors and venture investors, which represents a very small fraction of the available global wealth. This situation creates an extreme funding deficit and a major problem illiquidity.

This is a problem facing almost all DeepTech sectors, but the negative repercussions are particularly bad for the Longevity industry, as it leads on the individual level to reduced quality of life and unnecessary deaths, and also because it threatens to inflict crippling economic effects on national healthcare systems, pension and social security systems, and economies. Furthermore, in many cases such angel and venture investors are operating as sharks, exploiting this gross illiquidity for their own financial advantage, to the detriment of Longevity and other DeepTech startups.

Extreme abundance of financial assets are preserved rather than invested.

There are enormous amounts of financial assets, being conserved within the umbrella of family offices (and we can estimate that there are around 5,000 of these) and hundreds of very conservative financial institutions, which hoard this capital simply due to a lack of safe, stably growing and predictable financial derivatives into which to invest. There is no relevant methodology to assess the amount of such assets, as they tend to keep this a secret. But this is at least several tens of trillions of dollars.

At the same time, many owners of these vast sums of wealth are nonetheless personallyinterested in Longevity, both as a prospective market with the capacity for unprecedented growth, and as a means to their own personal life extension. Even the most conversative investors, and the owners of the largest financial assets, now very clearly understand that the industries of AI and Longevity, separately, are two of the most prospective and relevant sectors to invest in, with full confidence that such investments will lead to relatively low-risk and stable profitability in the long term. However, due to the lack of liquid tradable instruments related to the AI and Longevity industries, owners and managers of these assets still prefer to avoid any significant investments into these sectors.

Therefore, financial innovations that can provide liquidity to Longevity companies and technologies, and form a bridge between the Longevity industry and conservative financial markets, would inevitably enable the injection of something around 1% of the tens of trillions of dollars currently lying inert as "lazy money" within the global Longevity Industry. In practice this means once such liquidity bridge will be established it will have immediate ability to attract around 300-500 billions dollars, pessimistically just within the first few years and at least several trillions within 5-7 years horizon.

Currently the typical approach of these family offices and large financial institutions is to allocate 10% into alternative investments. Our most pessimistic estimate is that 10% of that wealth (and 1% of the multi-trillion total) could be reasonably invested into the Longevity industry, but only under one very specific condition: that mechanisms exist to provide investors with enough liquidity to be able to withdraw at least some of their investment within more reasonable timeframes than the typical lock-in periods of venture capital firms.

We could expect that 90% of that wealth would be invested into tradable financial synthetic instruments and derivatives built on top of the Longevity industry's companies, products, services, science and technology, and 10% as actual equity investment into the companies directly.

Considering the current natural pace of innovation in the Longevity and Financial industries, even without any specific innovations in the Invest-Tech field the current problem of illiquidity will likely be resolved naturally 7 to 10 years, but with these new bridges in place within 3 to 5 years. It is important that these solutions take into account the interests of both groups - startups, wishing to acquire additional funding, and conservative investors wishing to keep their funds in secure tradable financial instruments.

In the meantime, one method of dealing with illiquidity is the creation of more modern hybrid investment funds, which would serve as the above-mentioned bridge between conservative investors and Longevity startups, and can provide more liquidity for investors (LP’s) in comparison with the usual venture funds. Elements of such solutions are already present in other industries and can be returned and further improved using the modern tools of financial engineering and Invest-Tech.

A second, more innovative method of neutralizing these disproportions and inefficiencies would be the establishment of a specialized stock exchange for Longevity startups. Such an entity would be the first of its kind in the world, and if it is supported by key government officials, and integrated with the Longevity startups ecosystem, it could easily secure the position as a leading, progressive Longevity financial hub.

AIM (Alternative Investment Market - which is a subsidiary exchange of the London Stock Exchange) is one of the relevant examples, which is helping developing London as progressive hub of Europe providing simplified ways for mid level companies to become public.

It would also benefit the regional financial markets, enabling a multiplicative leap in the development of the host nation’s health care, preventive medicine, precision health, Longevity and financial industries. This specialized stock exchange focused on Longevity companies should aim to make IPOs for at least 100 Longevity startups within several years of its launch, and the launch of specialized financial derivatives with ties to the nation’s industry, and the subsequent launch of several specialized Longevity ETF’s (exchange traded funds).

The ultimate goal of this project would be the deployment of a Longevity Industry index (similar to the NASDAQ-Composite, which serves as an indicator of expectations on the growth of the USA tech industry).

The nation and stock exchange that does this would be capable of attracting up to 1 trillion dollars of investment into the Longevity index within the next 5-7 years, guaranteeing nearly unlimited opportunities for the growth of its Longevity, Preventive Medicine and Precision Health industries beyond any current expectations, its only potential obstacles being global black swans such as unprecedented, global financial recessions.

The first nation to establish a specialized Longevity Stock exchange will have effectively created something resembling a perpetual motion machine for the further growth of its national Longevity industry, having built an engine for providing its companies with sufficient investment and accelerating the market-readiness of their technologies, products and services.

The nation that establishes marketplaces for both shares in publicly-traded Longevity companies and for financial instruments and derivatives built as a second layer upon its Longevity industry, would be capable of attracting several trillions of potential wealth that is currently inaccessible and locked away.

To take this concept even further, if that nation were to then build a Longevity Index as a second layer on top of this Longevity Stock Exchange, to create the analogue of a NASDAQ composite for its HealthTech, Preventive Medicine, Precision Health and Longevity industries, this could become one of the most predictable, stably growing and rapidly-growing investment opportunities, capable of attracting trillions of pounds worth of lazy money from conservative investors. Furthermore, because Longevity is very much a science and technology-driven industry, it is much, much more simply predictable than for example the larger tech market or real estate market.

The Longevity industry will inevitably exhibit growth, for the following reasons:

-

It has a significant market size due to the increase in global life expectancies and other external factors;

-

It is beneficial for investors, as it accelerates their access to biomedical technology and life extension;

-

It is of great benefit to humanity, creating the products and services that will transport us all to new era of a long, comfortable and productive lives;

-

It is the most ethical way of conducting business, it is the way to generate enormous profits, bringing closer yourself to the most advanced longevity technologies, and delivering more health to humanity.

Longevity Stock Exchange and Longevity Composite Index - both Deep Knowledge Ventures and Aging Analytics Agency consider this topic particularly important, and are working in various ways to develop the concept of a specialized Longevity Stock Exchange, a marketplace for tradable financial instruments, securities and derivatives tied to the Longevity sector, such as the Longevity Index.

In a meanwhile in Q4 2019 we are launching a Longevity-focused hybrid hedge fund Longevity.Capital, which will combine data-driven analytical assessment and forecasting with novel Invest-Tech technologies adapted specifically for Longevity sector.

ADVANCING FINANCIAL LONGEVITY INDUSTRY ANALYTICAL REPORT

.png)

Aging Analytics Agency produced specialized analytical report focused on the intersection of Longevity, AgeTech, WealthTech and the Financial Industry - Exploring the Multi-Trillion Market of 1 Billion People in Retirement, a domain that is dominated by an even higher degree of complexity than government-led national Longevity development initiatives. The 500-page report consists of 3 volumes, the first one of which is open-access.

The main goal of this landmark report is to deliver practical answers to specific questions concerning the influence of aging on financial institutions’ activity in order to optimize their short and long-term strategies, with a new updated edition being released each financial quarter, incrementally increasing the precision, relevance and actionability of its industry analysis.

The report provides:

-

Deep quantitative analysis of the prospects of each sector of the financial industry within the context of current Longevity trends.

-

Clear forecasts on the 3-5 years horizon providing an overview of novel Longevity-related financial products and instruments that will be market-ready by 2022-2025.

-

Forecasting and scenario-building necessary for assembling the best possible tools and solutions to deal with Longevity risk and to gain profits from main Longevity trends.

-

Analysis and comparison of the key market players in the Longevity financial landscape.

.png)

The first volume of this report is open access and contains the analytics on the following topics:

-

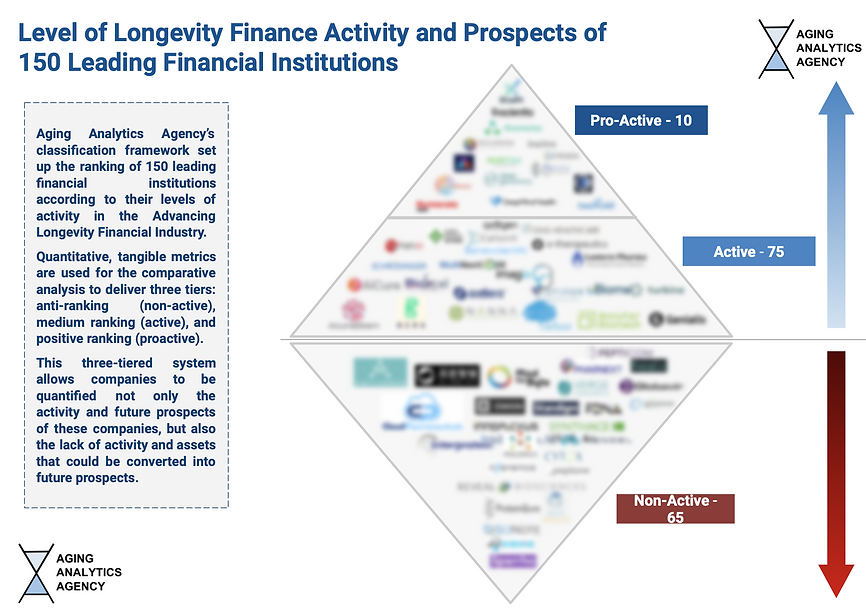

Top-150 financial institutions advancing financial Industry

-

Why the financial industry needs to monitor longevity trends and what is the interest of particular types of financial institutions in Longevity

-

Challenges Facing Financial Institutions Entering the Longevity / AgeTech / WealthTech Market

-

Rising Financial Hubs for the New Financial Industry

The first volume will be followed by a number of special case studies focused on specific sectors within the Financial Industry, assessing the activities, prospects and capabilities of large financial institutions, including the pension fund and insurance company industries, to enter the growing Longevity financial industry and adjust their business models to increasing life expectancies.

.png)

Volumes II and III of Advancing Financial Industry Longevity / AgeTech / WealthTech. Source: Advancing Financial Industry Longevity / AgeTech / WealthTech Volume I

The second volume of the Advancing Financial Industry Longevity / AgeTech / WealthTech expands the information presented in the first volume and provides an in-depth analysis of the industry concentrating on financial derivatives, new products appearing in AgeTech and WealthTech Segments and explains the necessity of using Health-Adjusted Life Expectancy (HALE), Quality Adjusted Life Years (DALY) and Disability-Adjusted Life Years (DALY). Currently, it is available by subscription for interested parties.

.png)

Longevity risk holders. Source: Advancing Financial Industry Longevity / AgeTech / WealthTech Volume I

The Advancing Financial Industry report addresses specific concerns regarding the risks posed by aging on financial institutions’ activity in order to optimize their short and long-term strategies. The above graphic featured in the report illustrates how to balance the risks facing facing governments, insurers, sponsors and individuals.

The second volume seeks to explore 3 main questions currently facing financial institutions at the present time:

-

What are the major threats and opportunities facing financial institutions regarding population aging?

-

What are the tools to deal with Longevity risk? How exactly can and should they be applied?

-

How can financial institutions benefit from the collision of Longevity megatrends?

The third volume of Advancing Financial Industry Longevity / AgeTech / WealthTech report is the most individualized version of the report. It is adjusted to the interests and specific needs of a party aiming to acquire the volume of the report. Particularly, it provides tangible analysis of specific segments of Longevity, relevant for a specific type of a financial institution.

Overall, the report overall profiles the top 150 companies in Advancing Financial Industry / AgeTech / WealthTech, is based on the assessment of the cumulative impact that each has contributed to the advancement of new technologies and methods in the aforementioned industries.

This cumulative impact is measured as a total sum of inputs from 3 highly overlapping categories:

-

a company’s financial contribution, based in the UK, or having significant presence in the UK;

-

the level of a company’s self-declared interest or lack of interest in the topic of Longevity, independent of the company’s actual, practical activities relating to Longevity;

-

a company’s actual activity and proactivity in Longevity-related markets or a company’s lack of tangible activities in Longevity-related markets despite having all the necessary resources to be well-positioned in such markets.

The new editions of the report will provide a more sophisticated, comprehensive and precise analysis of the challenges and opportunities related to the Financial Longevity Industry, as well as what financial institutions such as private wealth and retail banks, pension funds and insurance companies need to do in order to benefit, rather than stagnate, from the oncoming collision of two opposed Longevity MegaTrends: Advancing Biomedicine and Silver Tsunami. New editions will include:

-

Expanded quantitative metrics of advancing financial industry institutions and its analysis methodology;

-

Ranking of financial institutions by the efficiency of their participation in Longevity;

-

Updated list of advancing financial industry institutions;

-

Overview of the most notable events related to the industry that happened in the third quarter of 2019;

-

New predictions and possible scenarios analysis;

-

Quantitative assessment of concrete market opportunities related to Longevity.

Aging Analytics Agency’s analytical framework and methodology for its Advancing Financial Industry report takes into account not just the concrete, visible Longevity-related activities of financial institutions, but also the lack of activity and the future prospects for growth and entry into Longevity-related markets, assigning both positive and negative ranking.

Its specifically-designed analytical metrics (along with unique weight factors and overall metric and submetric structuring and layering) measure the prospects, proactiveness and opportunities that major financial institutions face against the challenges of an Aging Population and the opportunity of Healthy Longevity, and what tangible measures they can take to transform the problem and deficit-model of aging into an opportunity and asset-model of Longevity.

The access to the second proprietary volume of Advancing Financial Longevity Industry is available for professional parties of the financial market, interested in advancing financial longevity industry. To get access to Volume II, please contact us at info@aginganalytics.com

LONGEVITY-PROGRESSIVE COUNTRIES AND

GOVERNMENT NATIONAL LONGEVITY DEVELOPMENT PLAN REPORT

However, many of the financial reforms described in this article can realistically only be implemented in progressive countries led by technocracy-driven governments.

Several countries are working on establishing the grounds for fruitful future Longevity-related financial products and instruments, such as Switzerland for example. Switzerland in particular has all the elements necessary to become a leading Longevity financial hub, due to such factors as a lean political system that facilitates rapid implementation of integrated government programs, a strong research environment for geroscience, a strong research and business environment for digital health, and most importantly, international financial prowess.

Some specific programs that Switzerland has the power to develop in the next several years include development of a national industrial strategy for healthy Longevity for intensively developing its geroscience, advanced biomedicine and integration with FinTech and progressive financial industry to a state so advanced that it propels Switzerland into a central role in the internationally competitive Longevity business ecosystem, where it can rise to become a global leader in the specific field of the Longevity finance.

This was one of our reasons for publishing our Government Longevity National Development Plans Global Overview 2019, and with this concept of Longevity-progressive governance in mind several global hot spots of Longevity finance were identified and justified in the Advancing Financial Industry report.

In the next article we will describe this political, policy and governance dimension.

This increasingly real prospect of significant healthy life extension raises a certain number of frequent questions. Below are some of the more common concerns, and the authors’ position on each:

Does progress in Longevity imply that the rich will be living long and healthy and lives, with unique access to super-expensive life extension technologies, eventually make themselves super humans, while the poor will be living a short lives in poor health?

This horror story, fueled by media reporting on the science of life extension since the early 2000s, predicts that only the rich will have access to life extension and the poor will not be able to afford it, leading to horrific social disparities. The more realistic scenario is that due to its desirability and its usefulness, Longevity technologies will simply get cheaper. This was the case with cell phones. When they first appeared, they were affordable only to the relatively wealthy or were exclusive tools of business. But now a mere forty years after their introduction into mainstream circulation, they are ubiquitous and cheap. The same logic applies to Longevity technologies.

At the present moment, if a single person wishes to significantly extend their own life by as much a single decade, they would need to spend approximately 100-300 million dollars on some ad hoc biotechnological intervention, according to Aging Analytics Agency’s own assessment. However, over the course of the next decade or so, as such technologies become more standardized and better refined, they will become more affordable to all income groups.

Would not increased life expectancy lead to overpopulation and exacerbate the pollution problem?

The belief that increased life expectancy automatically leads to overpopulation and pollution is based on the false premise that current birth rates are independent of the biological clock. Whereas it is in fact well established that current birthrates are immensely influenced by a personal awareness on the part of both parents of the narrow window of opportunity presented by biological aging and its limits on fertility. With women in particular there is a now-or-never factor involved with the decision to procreate within the first forty years of life.

It is not clear whether - to give a hypothetical example - everyone were granted indefinite youth and fertility, average birth rates would have to be measured in terms of centuries or millennia. To some considerable extent (though not precisely known) less aging means longer fertility which means less frequent birth. And fertility is one of the very things which the Longevity industry is specifically attempting to extend. We know enough about the nature of aging to know that any comprehensive life extending set technologies would contain at least the promise of extending fertility also. Furthermore, history has repeatedly demonstrated that the speed of technological development is often more than enough to address the temporary challenges posed by population explosions. Indeed periods of technological improvement and population increase tend to coincide. In 10 years we will be living in a world of robotics and nanotechnologies. These industries will be attracting significant funds and thus are likely to achieve the resolution of these problems.

In a world of Longevity Finance, which will be the more precious asset for investment - physical wealth (such as real estate), or health (if indeed it becomes a new asset class)?

Health is expected to become a much more profitable asset for investment than physical wealth. Previously it was common to invest in real estate or other tangible assets to preserve wealth. One of the reasons for that was that it could be inherited within families. When it is possible to expand healthy life span, there is no need for private transfers. Thus, health becomes the new wealth and the priorities for investments change.

What is Longevity escape velocity and why does it matter a lot for the financial Longevity industry?

The principle of “Longevity Escape Velocity” dictates that with every passing year, further progress in technology further increases the current healthy life expectancy of a given individual. For as long as such a situation is sustained, wealth preservation is of less subjective meaning and value to that individual. What will come to matter much more than material wealth is the extent to which an individual can support the level of their health, happiness and other parameters. That is why it is worth investing in research into healthy life extension, by investing in the companies which are developing the necessary products and services to take us there.

What is the most efficient and ethical way of conducting business and generating high profits and at the same time delivering effective altruism in practice?

To work in the Longevity industry, and particularly in its financial sector is:

-

The most efficient and ethical way to do business,

-

The way to generate enormous profits,

-

The shortest way to bringing yourself closer to the most advanced life-extending technologies,

-

The most efficient form of altruism - delivering more health to humanity.

Finance specialists smart enough to realize this are now leaving financial organizations and joining various new Longevity ventures.

Conclusion summary

-

The threats and opportunity of global Longevity (the looming "silver tsunami") are of increasing interest to global finance, and are an increasingly frequent topic of discussion at international conferences, where there is increasing consideration among attendees of the future shape of global finance.

-

The future shape of global finance, if it is to withstand the tsunami, will necessarily consist of novel financial system: Longevity VC funds, Agetech Banks, Longevity Hedge Funds, Longevity Trusts, culminating in a Longevity Stock Exchange.

-

The increased liquidity that these would provide would set in motion a self-perpetuating cycle of Longevity Finance: The greater the progress in achieving healthy Longevity, the more the owners of wealth will want to invest in the repeatedly reinvigorated labour force endowed with greater healthspan, leading to further growth and greater healthy Longevity.

-

The nation that initiates these reforms would be capable of attracting several trillions in potential wealth that is currently inaccessible and locked away.

-

Such nations are more likely to be nations which Aging Analytics Agency has in the past characterized as “Longevity-progressive”, the definition of which could extend from small technocratic nations to large financial centers with detailed industrial strategies such as the UK.

If you would like to remain up to date on the most advanced forefront of the Longevity Industry, please click the subscribe button at the top of the page to subscribe to this Longevity Industry Newsletter.

This article was written by Margaretta Colangelo and Dmitry Kaminskiy

Dmitry Kaminskiy is General Partner of Deep Knowledge Ventures, Founding Partner of Longevity.Capital, Founder of Aging Analytics Agency, and Founder of Deep Knowledge Analytics. Dmitry is the Head of International Development of the Secretariat for the UK All-Party Parliamentary Group for Longevity, Managing Trustee of the Biogerontology Research Foundation. Dmitry is based in London.

Margaretta Colangelo is Managing Partner of Deep Knowledge Ventures and Managing Partner of Longevity.Capital. She is Co-Founder of Aging Analytics Agency, Co-founder of Deep Knowledge Analytics, and Co-founder of Longevity.Capital. Margaretta serves on the Advisory Board of the AI Precision Health Institute at the University of Hawai‘i Cancer Center. Margaretta is based in San Francisco. @RealMargaretta

Click here to follow the Deep Knowledge Group on LinkedIn.

Deep Knowledge Ventures is a leading investment fund focused on the synergetic convergence of DeepTech, frontier technologies and technological megatrends, renowned for its use of sophisticated analytical system for investment target identification and due-diligence. Major investment sectors include AI, Precision Medicine, Longevity, Blockchain and InvestTech. Deep Knowledge Ventures led Insilico Medicine’s seed round in 2014 and has remained a close advisor in the company’s journey towards becoming a global leader in the application of advanced AI, particularly DL and GANs. @DeepTech_VC

Aging Analytics Agency is the world’s premier provider of industry analytics on the topics of Longevity, Precision Preventive Medicine and Economics of Aging, and the convergence of technologies such as AI and Digital Health and their impact on healthcare. The company provides strategic consulting services in fields related to Longevity, and currently serves as the primary source of analytics for Longevity.Capital and for the UK All-Party Parliamentary Group for Longevity. @AgingAnalytics

Longevity.Capital is a specialized Longevity-Focused Hedge Fund with enhanced liquidity that uses hybrid investment technologies to combine the profitability of venture funds with the liquidity of hedge funds, significantly de-risking the interests of LPs and providing the best and most promising Longevity companies with relevant amounts of investment. Longevity.Capital on LinkedIn

Deep Knowledge Analytics is the DeepTech analytical arm of Deep Knowledge Ventures, specializing in forecasting on the convergence of technological megatrends, conducting special case studies and producing advanced industry analytical reports on the topics of AI, DeepTech, GovTech, Blockchain, FinTech and Invest Tech. Its Pharma Division is the leading analytical entity specifically focused on deep intelligence of the Pharma industry and the AI for Drug Discovery sector, and serves as the main source of market intelligence and analytics for Pharma-AI, a specialized hybrid hedge fund. @DK_Analytics